FIX INEQUALITY = CHANGE THE INCENTIVES AND DISINCENTIVES TO FAVOR PRODUCTIVE INVESTMENT AND INNOVATION RATHER THAN FINANCIALIZATION

“A NATlON that continues year after year to spend more MONEY on military defense than on programs of SOClAL uplift is approaching spiritual death.”

— Martin Luther King Jr

Financialization = Make DEBT into a Commodity (like Coffee or Gold) backed up with some asset like a house or a person’s income + use of massive amounts of low-cost credit to leverage and pyramid speculative gains separated from RISK.

Financialization = Replaced innovation and productive investment

Globalization = Replaced with Self-Sustaining with most Goods and Services from Home

“The poverty of our century is unlike that of any other. It is not, as poverty was before, the result of natural scarcity, but of a set of priorities imposed upon the rest of the world by the rich. Consequently, the modern poor are not pitied…but written off as trash. The twentieth-century consumer economy has produced the first culture for which as beggar is a reminder of nothing.”

― John Berger

425 MULTINATIONAL BILLIONAIRES

311,OOO,OOO REAL PEOPLE – UNORGANIZED VICTIMS

Piketty = DEBUNKS Trickle-Down BS = DEBUNKS Rising tide lifts all boats = DEBUNKS SUPPLY SIDE BS = DEBUNKS JOB CREATOR MYTH

GOP + MULTINATIONAL BILLIONAIRES SALES JOB = DESTROYED MIDDLE CLASS

GOP EMPIRE OF LIES = ENDS WITH PIKETTY RESEARCH

https://concisepolitics.wordpress.com/category/gop-empire-of-lies/

“One half the world does not know how the other half lives.”

— Benjamin Franklin 1755

“I have no doubt but that the misery of the lower classes will be found to abate wherever the Government assumes a freer aspect, & the laws favor a subdivision of property.”

— President James Madison 1787, “a subdivision of property?”

“All communities divide themselves into the few and the many. The first are the rich and well born, the other the mass of the people.”

— Alexander Hamilton 1787

“It is only in Civilized nations where extremes are to be found in the human species – it is here where wealthy and dignified mortals roll along the streets in all the parade and trappings of royalty, while the lower class are not half so well fed as the horses of the former. It is this cruel inequality which has given rise to the epithets of nobility, vulgar, mob, canaille, etc., and the degrading but common observation – Man differs more from man than man from beast – The difference is purely artificial. Thus do men create an artificial inequality among themselves, and then cry out that it is natural.”

— Thomas Paine 1791

Thomas Paine was the most influential political philosopher of the American Revolution, now all but forgotten, especialy by Conservatives.

“:To provide employment for the poor and support for the indigent is among the primary . . . cares of the public authority.”

— President James Madison 1820

┈┈┈┈┈┈┈┈┈┈┈▶

UPDATE:

Aggregate demand = Propels economic recovery in slumps = DEMAND SIDE ONLY

Stimulation of demand IN A DEPRESSION = A NECESSITY WITH NO BUBBLE

Means of WEAPONS production = Not idle = ONLY manufacturing jobs LEFT

USA = 3rd WORLD = Exporting raw material and importing finished goods

Stimulating demand by EMPOWERING POOR = FEEDS FAMILIES who SPEND EVERY CENT TO SURVIVE = Demand for FOOD and Housing and Supplies = REDUCES RELIANCE ON DEBT

US wealth disparity = Reached the tipping point = SPLUTION: TAX WEALTH ONE WAY OR ANOTHER = RICH can AGREE or FACE FAR WORSE

USE WEALTH TAX = INSTITUTE A MINIMUM INCOME TO MASSIVELY REDUCE INEQUALITY + Americans can build on that with Creative Innovative Hard Work + Do away with WELFARE PROGRAMS (KEEP SS, MEDICARE, HEALTH CARE)

TAX WEALTH TO OFFSET INEQUALITY SOLUTION = NO GOV DEBT INCREASE

Alternative = WORSE THAN LABOR WARS = Americans Loss of LIFE

SUPPLY SIDE = TRICKLE DOWN FROM BILLIONAIRES LIES + JOB CREATOR LIES

NEED DEMAND SIDE AND TO MINIMIZE INEQUALITY = GROW MIDDLE CLASS

┈┈┈┈┈┈┈┈┈┈┈▶

Financialization = Leverage of information INEQUALITY = Wealth creation by ADVANTAGE

http://www.globalresearch.ca/whats-the-primary-cause-of-wealth-inequality-financialization/5374930

Emmanuel Saez and Thomas Piketty = Economists devoted to deepening our understanding of INEQUALITY.

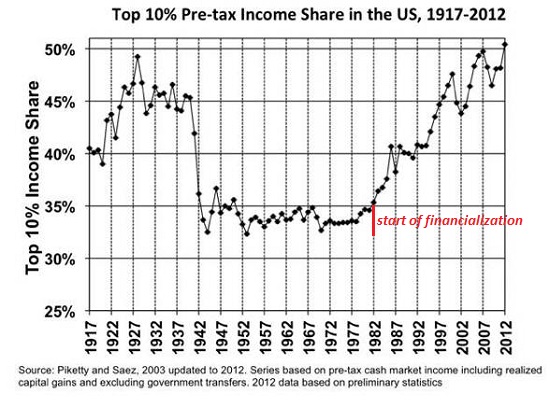

Emmanuel Saez = Documents widening gulf between the top 1% and the bottom 90% from 2009 to 2012 = Chart of top 10% share of income in red marking the beginning of financialization in 1982

http://elsa.berkeley.edu/~saez/saez-UStopincomes-2012.pdf

Profits from Leveraging and betting on Financialization = Far exceed wealth generated by creating products and services = The economy is soon hollowed out

Financialization and Betting = Perverse incentives start driving every business decision and strategy ending innovation and productive investment

Coming out of Great Recession in 2009 = BEST SCAM EVER

Great Recession = MAXIMIZED Inequality = Opposite of Great Depression

MAXIMIZED Inequality = Investment returns exceed economic growth = Rich get richer QUICKER + Tax laws that allow virtually unlimited inheritances to pass from generation to generation. = like 18th and 19th century France reversed only by sharp-edged popular responses.

MAXIMIZED Inequality = When an REAL economy grows at 1% / Year but investment returns are 5% = Already very wealthy need to reinvest only a 20% of their gains for their fortunes to grow at the same rate as the overall economy. The rest can be spent on a sumptuous lifestyle.

Tiniest sliver of the wealthiest and highest-earning = Do not need to consume 80% of their incomes = Reinvest the 80% of gains in the market. Over time this snowballs into GREATER WEALTH!

- This trend emerged in the mid-1970s

- Accelerated under Reaganism

- Took off like a rocket after the tax cuts and anti-regulatory policies of GW Bush

TOP 1% = Raked in 95% of 21st century wealth and income increases (2009-2014)

33% of all WEALTH AND INCOME went to just 16,000 households = Top 1% of 1%

1934 Bottom 90% incomes grew 8.8% over the prior year 2012

Bottom 90% LOST 15.7% of their INCOME (2009-2012)

CURRENT POLICIES TO BLAME FOR INEQUALITY = Because savings from current wages and salaries cannot grow as much as returns on existing riches – whether capital is taxed or not (CAPITAL SHOULD BE TAXED REGARDLESS for Deficit Reduction).

WEALTH Accumulation “becomes more rapid and (UNEQUAL) as the return on capital rises and the [overall economic] growth rate falls.” — Piketty

SOME CAPITAL is used creatively and productively – like a startup company or building something with REAL tangible value. Productively invested capital is at risk and generates additional production of goods and services.

But CAPITAL under CURRENT PERVERSE POLICIES = Invested in rigged financier games funded by the Federal Reserve (for example, carry trades and high-frequency trading) is entirely different from capital that is placed at risk in a start-up company.

CURRENT POLICIES TO BLAME = Capital in pyramiding the mortgage into mortgage-backed securities (MBS) and exotic financial instruments based on the MBS = NO VALUE ADDED and skims profits from leveraging debt = A giant skimming operation based on information INEQUALITY = Outright leveraged fraud and misrepresentation of fraudulent investments.

FED-Funded (near 0% to Big Banks) Financialization = Creates Perverse Incentives = Talent and capital flow to unproductive skimming operations to MAXIMIZE LOOTING, effectively starving the real economy of talent and capital.

FED = Makes essentially limitless funds available to banks and financiers at near-zero interest rates to do the SKIMMING OPERATIONS.

FED = Refuses to loan $100,000 at 0.1% interest to 99% of Americans FED = Happily lends $BILLIONS at 0.1% to the Privileged Big Banks and Financiers = Financial predators and parasites.

Financialization by Financier skimmers = Stripmine the REAL economy = Stripmine productive assets and labor.

FED-Funded (near 0% to Big Banks) Financialization = Free money to financiers and no limits on debt, leverage, information INEQUALITY (Fraud) and sleight-of-hand accounting, the only result possible is widening wealth INEQUALITY.

FIX INEQUALITY = Abolish the FED

FIX INEQUALITY = Eliminate the too-big-to-fail banks

FIX INEQUALITY = Tax speculative profits from high-frequency trading at 90%

FIX INEQUALITY = Tax other skimming operations at 90%

FIX INEQUALITY = Lower the corporate tax rate on productively invested capital to 5%.

FIX INEQUALITY = Change the incentives and disincentives to favor productive investments and innovation rather than Financialization.

Piketty = Suggests a global tax on capital and inheritance = Curb tendency to a skewed distribution of income in favor of property holders. = Technically feasible since information on the ownership of most assets, from housing to stock shares, is available.

Piketty GLOBAL CAPITAL TAX RATE STRUCTURE:

- 0% Tax on capital below almost $1.4 Million

- 1% Tax on capital between $1.4 Million and $6.8 Million

- 2% Tax on capital above 6.8 million dollars.

Requires all leading countries to coordinate to avoid capital flight = uniform taxation of wealth = The only way to “regulate capitalism” and make both capitalism and democracy sustainable in the long run.

SOURCE:

http://www.globalresearch.ca/whats-the-primary-cause-of-wealth-inequality-financialization/5374930

Piketty = Government policy = distribution of wealth and income

Piketty = Proposals like Steve Forbes flat tax = Taxes wages and business profits, but not capital gains, dividends or interest

Piketty = Proposals like Steve Forbes flat tax = The already rich could live tax-free while workers would bear the full burden of government.

WEALTH DYNASTIES = A serious long-run problem = Ended French monarchy

DYNASTIC WEALTH = Benefits those with rich parents while limiting economic opportunity for everyone else, Piketty shows under all inheritance methods = Automatically lead to a very highly concentrated WEALTH in a few hands over generations = “The cumulative dynamics of wealth accumulation will automatically give rise to an extremely high concentration of wealth,” with half of the capital owned by the top 1 percent, while the bottom half end up with no savings, he says.

DYNASTIC WEALTH = Curable with Smart TAXES on LARGE Inheritances

The already rich need and use business and investment managers = CEOs or “supermanagers.” = Slightly broader distribution of wealth than 18th Century France = gilded age. = “probably detriment to low- and median-wage workers, especially those who own only a tiny amount of property, if any.” = Moderate wealth holders have an incentive to push down wages to reap greater rewards for themselves.

Piketty’s genius = Shows how thick wallets shape rules and morality = Thwart ambitions when society’s focus is on preserving the fortunes of the already rich.

1835 France = Wealth was so concentrated that “those who could somehow lay hands on inherited wealth were able to live far better than those obligated to make their way by study and work.” = Marriage into wealth was the only option.

Piketty = says with Current Policies that encourage dynastic wealth that favor returns to capital over income from labor, we are headed back in that 1800‘s direction and potential catastrophe. = Even the strivers will have a tougher time

To Stop the Trend to DYNASTIC WEALTH and its CHAOS = Smarter POLICY CHOICES are easy = CHANGE INCENTIVES AND DISINCENTIVES.

┈┈┈┈┈┈┈┈┈┈┈▶

Thomas Piketty’s “Capital in the 21st Century” = Most important economics book of Decade.

Interest on Wealth = GROWS OUT OF PROPORTION INCOME = LOW TAX

Policy Interventions = Only way to STOP GROWTH OF INEQUALITY

Inequality in 2014 = 19th century Economic Elitists inherited wealth = NO WORK

TAX WEALTH = Best solution globally

Thomas Piketty = French economist rose to prominence with Emmanuel Saez on income inequality. = First to carefully Research American income tax data to show how highly concentrated income was in the hands of TOP 0.01%. Piketty now focuses on wealth inequality.

Thomas Piketty = Market capitalism including Europe = Eventually leads to dominance by born into a position of inherited wealth. = Like early 20th century = tyranny of inherited wealth destroyed by the devastation of two world wars = 21st Century USA + Canada will suffer from the same affliction.

DEFINE CAPITAL = Wealth = Shares of stock + Bonds + Houses + Cash assets

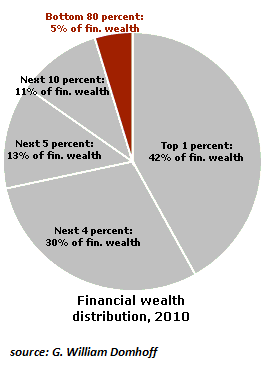

CAPITAL OR WEALTH = Much more unequally distributed than even income

DIVIDE IN SOCIETY = Those who own things + Those who work for a living

USA = 5% of households own Majority of the wealth + Bottom 40% have negative wealth (debts)

FACT = Society dominated by the unearned wealth of a hereditary elite

FACT = Market societies = Dominated by owners of capital

Political Focus = Welfare state or social safety net for the poor = NOT architecture of capitalism

Piketty = Fortunes of wealthy were destroyed by two world wars + Great Depression + Extreme wartime finance measures. A few decades of rapid economic growth created a situation in which newly earned income was a much bigger deal than old wealth. = NOW OVER = Slow economic growth =

Piketty SOLUTION = Drastic measures = TAX ON WEALTH = Or future belongs to people who simply own stuff they inherited from their parents.

Piketty = Main concepts = Wealth MAXIMIZES INCOME + CAPITAL rate of return (“r” in his book) to GDP (“g”) = wealth:income ratios for different countries over the long term.

If RETURN (INTEREST) on WEALTH is 7% and GDP is 2% (Anything below 5%) = Wealth of Already-Wealthy grows Much faster than the economy as a whole and the 99+% lose ground. = The rich will get richer

Piketty’s main finding = Exhaustive look at wealth Piketty finds in all developed countries the wealth:income ratio is high and rising = GREATER INEQUALITY.

WEALTH INEQUALITY HISTORY:

Extremely high in late-19th and early 20th centuries

Very low at mid 20th century

Rising strongly since 1980

Piketty Finds = Rate of return on capital is 5% on average = Growing wealth inequality = Built into capitalism not economic policies (OTHER THAN TAX POLICY)

Piketty = The way capitalism works at 5% rate of return = Labor income grows at the rate of overall GDP growth.

If r > g then passive wealth-owners grow faster than labor income earned by workers = The wealthy get wealthier = Greater Inequality

Piketty = In 19th Century a man’s “income” is the rent received by the estate he inherited, not his salary = Central importance of inherited wealth was conventional wisdom in pre-war Europe = Political radicalism in pre-war Europe.

Piketty = WW I directly destroyed some wealth + Led to very high levels of taxation (90+% TOP RATES) + Inflation from wartime finance measures + The Great Depression with fortunes wiped out + WW II directly destroyed even more wealth (cities burned to the ground) + Even more extreme wartime finance measures.

Piketty = Post WW II came a fast period of postwar growth associated with European reconstruction and the unleashing of long-suppressed consumption impulses.

Piketty = Now we are back to Pre-WW I conditions since 1980 Reagan-Thatcher ERA.

Piketty = Supercharges existing debate on inequality = TAX WEALTH POLICIES

Piketty = The gap between high salaries and low ones is SECONDARY to The gap between people who inherit large sums of money and those who don’t.

Piketty’s vision = A class-ridden, neo-Victorian society dominated by the unearned wealth of a hereditary elite = Sharply repulsed by liberal notions of a just society + conservative WORK ETHIC is all that matters to get ahead + The idea of entrepreneurs

Piketty = We are headed for a world of inherited aristocrats dominated = Not a world of founders of new companies = The grandchildren of today’s super-elite.

Piketty Solution = A modest global wealth tax to prevent the wealthy from using TAX DODGING jurisdictions (Cayman or Swiss) + In short term USA and EU should move ahead with wealth taxes, estate taxes, and other efforts to curb the power of wealth.

Piketty Solution = Difficult to do when THE WEALTHY RULE with CONNECTIONS and MONEY

Piketty = Growth-boosting policies would forestall INEQUALITY GROWTH = But the BURDEN ON THE PLANET would soon END LIFE as we know it.

OTHER SOLUTIONS = Politically easiest way is to increase economic growth rate = Mechanically increasing the population growth rate = Pro-fertility measures or more liberal immigration rules might do the trick.

OTHER SOLUTIONS = Narrow Wealth-destruction methods (NARROW TAX rather than a broad wealth tax or a world war) = Modern-day wealth = Urban land + Control over oil and other fossil fuel resources + Value of various patents, copyrights, trademarks, and other forms of intellectual property. = A very high rate of taxation on LAND won’t cause land to go away or oil to vanish. + Major intellectual property reform = Achieve some INEQUALITY MINIMIZING GOALS

Branko Milanovic’s 20-page review in the Journal of Economic Literature

ESTATE TAXES: 98% PAY ZERO

Very large estates PAY below 20%.

Estate worth more than $5,340,000 could pay a marginal tax rate of up to 40%

The estate tax brings in about $20 billion a year.

┈┈┈┈┈┈┈┈┈┈┈▶

Inequality Affects Our Existence

Sophisticated empires fall = human interaction with nature + Economic INEQUALITY

MODEL = System of equations called HANDY, or Human and Nature DYnamics = Predator-prey model = Two classes of individuals: elites and commoners = FINDINGS Economic INEQUALITY leads to collapse + Devastating effects of depleted natural resources hit the commoners first and ultimately wiped out the elites as well.

Disastrous outcomes was furthered by the lag in impact on the two populations.

Elites Buffer of wealth = Slows detrimental effects of the environmental collapse = Elitists continue ‘business as usual’ despite the impending catastrophe = Roman + Mayan empires = Sophisticated but couldn’t avert their own demise.

Today = Already a strain on Natural Resources due to high consumption + Extremely High Inequality (Headline News) + Climate change is damaging populations worldewide.

USA # 1 IN INCOME INEQUALITY AMONG DEVELOPED COUNTRIES

USA # 1 IN WEALTH INEQUALITY AMONG DEVELOPED COUNTRIES

INEQUALITY = BY RACE + MEN AND WOMEN

TODAY’s Data + Scientists’ findings = On our way to collapsing if we don’t address these circumstances. = Policy changes (TAX the RICH) that attack inequality and resource depletion (Carbon Tax) can avert collapse. = People are sounding the Alarm = But Minor changes won’t do = Require action that is Quick and Effective, nationally and internationally.

EMPIRES FALL QUICKLY: Roman Empire + Han + Mauryan + Gupta + Mesopotamian Empires = Advanced, sophisticated, complex and creative civilizations can be both fragile and impermanent.

┈┈┈┈┈┈┈┈┈┈┈▶

Latin America = Decline in inequality = Largely policy-driven = Raising the MIN WAGE + Conditional cash transfer programs for poor & particularly female-headed households.

http://inequality.org/trillion-families/

3 FAMILIES = $.333 Trillion Concentrated Wealth -by Bob Lord, Institute for Policy Studies associate fellow

HANDFUL of Families = Together hold over $1 trillion in wealth.

Billionaire David Koch divides time between

$37-million mansion in Palm Beach

$18-million beachfront estate in Southampton

$9.5-million apartment in Manhattan

$15-million mountain getaway in Aspen

51 Wealthiest now Share wealth held a generation ago by 1,500 wealthiest

3 CLANS: Koch, Walton, and Mars = $333 BILLION in Wealth = Bloomberg

Actual wealth = likely runs HIGHER

KOCH HISTORY:

$6.8 BILLION in 1999

$72 BILLION in 2013 10 FOLD GROWTH

$101 BILLION in 2014 BLOOMBERG 20% ANNUAL GROWTH

Average billionaires = Getting richer FASTER

It takes WEALTH TO GROW WEALTH using Interest.

99% are SOL in accumulate wealth at such a clip. 7% would be INCREDIBLE! 20% is UNHEARD OF GROWTH FOR JOE BAG OF DONUTS

The TRICK is Tax policy.

Ordinary Americans pay TWICE = Income taxes + Employment taxes on labor + Consume the bulk of what’s left on living expenses.

Billionaires don’t face income tax or employment tax = Overwhelmingly capital supplies their INCOME and WEALTH. Their living expenses = A sliver of their annual income. They pay income tax when they sell assets AT LOW CAPITAL GAINS RATE.

Federal estate tax receipts today = 1% of wealth passed to NEXT generations.

The emasculated estate tax law means these 3 mega-rich CLANS = LOW Inheritance Taxes using tax planners LOOPHOLES.

TAX POLICY MUST CHANGE to REDUCE INEQUALITY

TAX CORPORATIONS LIKE 1950

TAX FRONT RUNNING on Wall Street at 90%

14,OOO LOOPHOLES must be reduced.

TAX Capital Gains at Labor rates – Meet in the MIDDLE

TAX inheritance high enough to reverse at death all advantages the super-rich

TAX PURE SPECULATION = No useful value to Society

TAX JOBS SENT OFFSHORE

These steps = Reduce concentration of wealth at the top

┈┈┈┈┈┈┈┈┈┈┈▶

Charles and David Koch have more wealth than Bottom 40% of Americans together = KOCH BROS use their vast wealth to change rules and laws to fit their political views. = Undermining our democracy = Betrayal of America’s most precious thing. = Kochs strike at the heart of America. Political power tends to rise to where the money is. — Tilts the playing field in favor of the Kochs, and against the rest of us. KOCHS are driving America into an oligarchy.

1950s American democracy = “pluralism” = Capacities of parties to reflect preferences of the vast majority of citizens.

Reagan Era began focusing income and wealth concentrated at the top = GOP and Democrats started to morph into extracting money from mostly wealthy people. = Supreme Court’s “Citizen’s United” decision in 2010 = Billionaires created their own political mechanisms, separate from the political parties. Buying political candidates of their choice, and creating their own media campaigns to sway public opinion toward their own views.

2014 election cycle, “Americans for Prosperity,” the Koch brother’s political front group aired 17,000+ Broadcast TV commercials VERSUS GOPs 2,100 Ads.

“Americans for Prosperity” = Outspending Democratic super PACs in Senate races GOP are targeting this year. = 2-to-1 ADVANTAGE = Democratic super PACs have had virtually no air presence in five of the nine states.

Kochs spawned imitators. = 4 of top 5 contributors to 2014 super-PACs are now funding their OWN political operations = BYPASSING GOP AS MULTINATIONALS TRY TO DOMINATE NATIONS.

Billionaire Ricketts have own $25 million political operation called “Ending Spending.” TV ads against GOP Representative Walter Jones in a North Carolina primary for too often voting with Obama. + ads that attack Democratic New Hampshire Senator Jeanne Shaheen for supporting Obama’s health-care law.

Billionaires REPLACE political parties = BUY candidates beholden directly to billionaires. = Billionaires completely in charge.

China Casino Adelson worth $37.9 Billion is interviewing GOP candidates in what’s being called the “Sheldon Primary.” = The ‘Sheldon Primary’ = “It goes without saying that anybody running for the Republican nomination would want to have Sheldon ($1OO,OOO,OOO) at his side.”

Democratic-leaning billionaires Tom Steyer, a former hedge-fund manager, and former NYC Mayor Michael Bloomberg, have also created their own political groups. But even if the two sides were equal, billionaires squaring off against each other isn’t remotely a democracy.

NO DEMOCRACY = BILLIONOCRACY = CONCENTRATED WEALTH & POWER

“Capital in the Twenty-First Century,” economist Piketty explains why the rich become steadily richer with wealth concentrated in few hands = WEALTH generates its own INCOME and EVER MORE WEALTH (USURY INTEREST) = Richest receive almost all the income growth. = Leads to EVER HIGHER INEQUALITY and FAMILY Dynastic Fortunes handed down from generation to generation = NEW ARISTOCRACY of a NEW Gilded age = Must be stopped through concerted political action. FACT: Only large-scale political action TODAY = Charles and David Koch, and their billionaire imitators.

http://www.huffingtonpost.com/robert-reich/koch-brothers_b_5034195.html

┈┈┈┈┈┈┈┈┈┈┈▶

Growth in US inequality since 1980s = 2 CAUSES:

WAGES STAGNATED for 99% = 2.5% Total Increase 1986 to 2014

Incomes for 1% Skyrocketed = EXPLOSIVE GROWTH!

Both must be corrected to close GAP between Superrich and everyone else

Piketty writes that this explosion “reflects the advent of ‘supermanagers,’…top executives of large firms who have managed to obtain extremely high, historically unprecedented compensation packages.”

Late 1990s Clinton Era = Employment growth was strong (3.8% UNEMPLOYED) and workers secure significant wage advances.

After 2000 Bush Era Ended = increase in income only for the very wealthy

Why did managers experience giant increases when everyone else Stagnated?

Piketty’s says Giant Reduction in tax rates for high income earners during Reagan/Thatcher ERA dropped Marginal tax rates for rich from 80-90% to 30-40%.

Piketty writes, “1950s and 1960s, executives in UK and US firms had little reason to fight for such raises… because 80-90% of increase would in any case go directly to the government.”

Piketty writes = By 1980 “the game was utterly transformed.” and Executives “went to considerable lengths” to persuade compensation committees to grant them big increases = EASY INSIDE JOB as “members of compensation committees were often chosen in a rather incestuous manner” = Other Executives

Piketty’s pattern = Nations with Lower tax rates on 1% = Executive PAY GREW

Piketty’s pattern = Where taxes on 1% was flat = Executive PAY was Flat

Piketty’s Proved = Increase in 1% PAY = NO payoff for economy = No Productivity Gain

Piketty’s Proved = INEQUALITY is due to TAX POLICIES + other GOV Policies = Nothing foreordained about growth of inequality = NOT inevitable. = POLICIES Tax rates for RICH went down = Because Congress DID IT + REAGAN SIGNED IT

Unemployment remains high because GOV rejects increasing government spending and TAXES ON 1% in order to reduce the unemployment rate.

RICH set AGENDA via BRIBERY by Rich political donors = Executives + Billionaires = Demand Congress + President SET TAXES LOW on 1%

Congress + 1% = LOW taxes on Corporate profits = LOWEST since 1920‘s

Congress + 1% = Love high unemployment high = LOW WAGES

Congress + 1% = Growing inequality = Logical outcome of BRIBERY in politics

0.1% Super Rich = Influence over political outcomes = They are Beneficiaries = Real source of income inequality.

BRIBERY = POWER = POLICIES FOR HIGHER INEQUALITY

END EXTRAORDINARY BRIBERY = ENDS EXTRAORDINARY INEQUALITY!

Click for Article by Jay Mandel, Professor of Economics, Colgate University

┈┈┈┈┈┈┈┈┈┈┈▶

$1,265,836,000,000 = Cash S&P 500 companies (NO banks/financiala) SIT ON

$1.27 trillion or 13.5% More than last year.

Companies are generating cash faster than they can spending it.

Great news for Big Business: Corporations are excused from taxes = 12.6% rate

Corporate income tax = Performing a magical disappearing act for decades.

6% of GDP (1952) Corporate income tax revenues

3% of GDP Pre-Reagan Corporate income tax revenues

1% of GDP (1983) Reagan’s tax breaks Corporate income tax revenues

No wonder the corporate cash pile keeps growing and growing and growing.

Non-corporate entities in America?

11 Million AMERICANS Unemployed

7 Million Americans in part-time jobs

1 in 5 households in America has a negative net worth = owe more than they own. 48 million Americans have no health coverage

48 million rely on food stamps to stave off hunger

20% of all American children live in households surviving on $2,000/month or less

“It was the best of times, it was the worst of times.”

— Charles Dickens in A Tale of Two Cities

BEST = MULTINATIONALS AND BILLIONAIRES AND CEOs

WORST = Ordinary Americans = Mothers, Fathers and Kids

“cause and effect” Connect these Conditions = Inequality as the richest 1% take 50% of everything = HISTORIC HIGH = HIGHEST IN DEVELOPED WORLD USA = Far more inequality than every major European or East Asian nation.

Inequality causes poverty through economic mismanagement.

Huge corporations and RICH don’t spend their money = They just sock it away = Like Scrooge Mc Duck

400 in Forbes list = $2+ Trillion in wealth = Remains OFF-SHORE year after year – Drained from US real economy, and are not reinvested in America. = Massive and chronic shortage in “aggregate demand.” = When demand falls short then unemployment explodes.

FED Reserve papers over this evaporation of OUR money = “quantitative easing” and Growth of enormous debts.

People without jobs = “reserve army of unemployed” = Fuels poverty by WAGE DEPRESSION = Desperate people bid down the price of labor to survive. 1970s LEVEL WAGES HERE in 2014! = NO GROWTH! = Compete with Asian Slave Labor

America = Nation of cheap labor thanks to GOP since Reagan = TRICKLE DOWN LIE + JOB CREATOR LIE! = ZERO reinvestment in AMERICA (TOO RISKY) WHEN YOU CAN DROP RISK ON OTHERS USING SCAMS! = Businesses see labor simply as a cost they MINIMIZE TO BOOST PROFITS! = NO TRICKLE! MORE LIKE SUCKING!

TAX POLICY IS UPSIDE DOWN = Buffett’s secretary pays higher tax rate than Buffett = TRANSFERS LOOT TO THE TOP O.O1% with 14,OOO TAX LOOPHOLES!

The evening news desperately avoids these facts. = Owned by BIG MULTINATIONALS SO NOTHING IS DONE!